From August 15th, 2021 all foreigners residing and working in Shanghai will be required to pay social security contributions on a mandatory basis. This update follows the expiry date of the local Notice of Shanghai Municipal Human Resources and Social Security Bureau (Hu ren she yang fa [2009] No.38, the Notice), which had provided preferential treatment to foreign residents in Shanghai until August 15th.

China’s social security system consists of five different types of insurance (pension, medical, unemployment, work-related injury, and maternity) and a housing fund scheme. The National Social Security Law has required Chinese companies and their employees to pay contributions to the Chinese social security system since October 15th, 2011. However, foreigners and residents from Hong Kong, Macau and Taiwan working in Shanghai (and their employers) have been following the above-mentioned Shanghai circular which stated that they could make contributions voluntarily. Often, employers would opt to not make any social security contributions. For this reason, after the expiry date of the circular, employers and employees should expect to see an increase in costs.

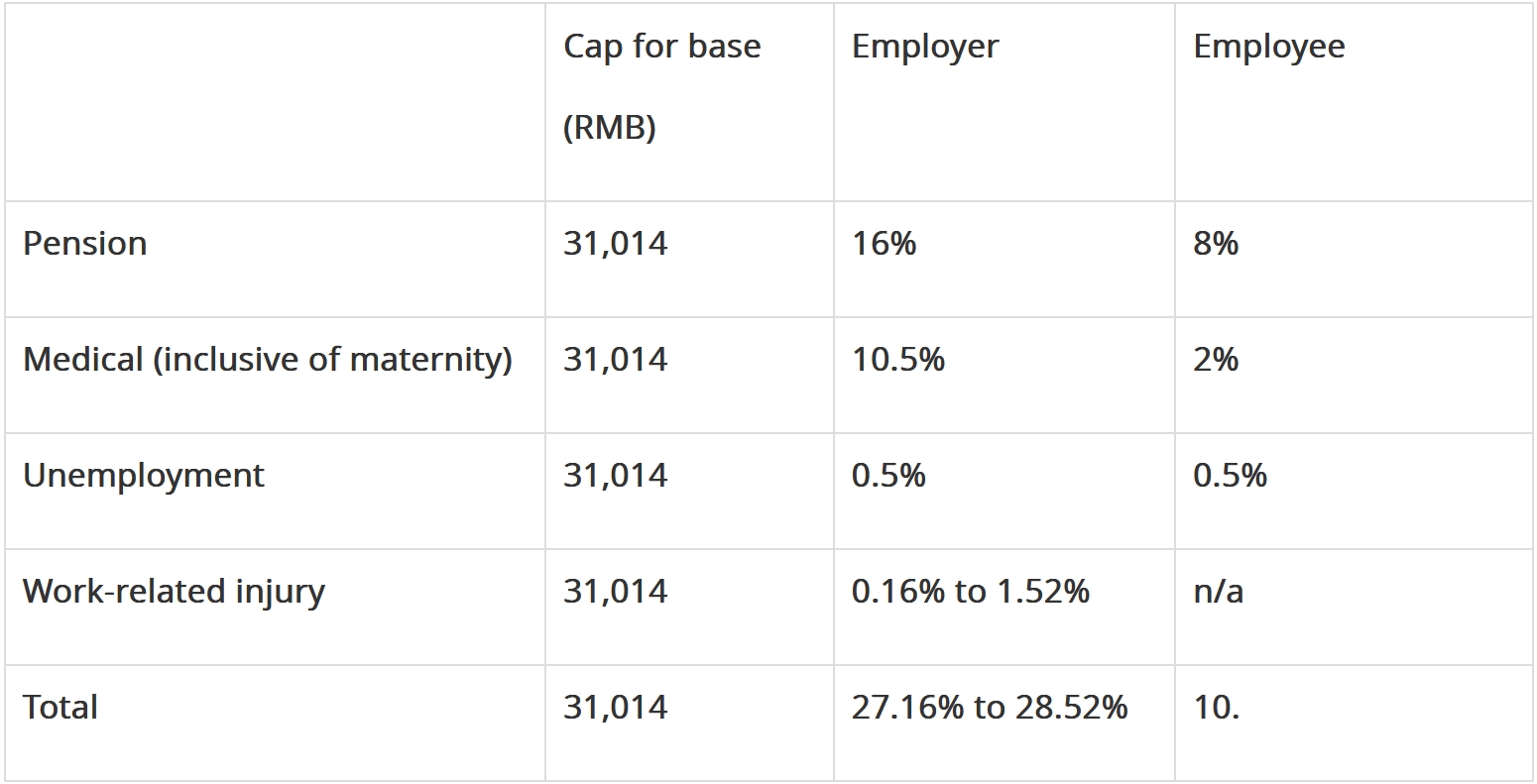

The latest social contribution rates in Shanghai are as follows:

Generally, the contribution base is capped at 300 percent of the average local salary which is RMB 31,014 for Shanghai province in 2021.

China has already signed and started implementing social security agreements with 11 countries – Germany, South Korea, Denmark, Canada, Finland, Switzerland, the Netherlands, Spain, Luxembourg, Japan, and Serbia. Citizens of these countries currently working in China are eligible for social security contribution exemptions.

Foreigners who leave China before reaching the retirement age can submit a written application to terminate the social insurance individual account. The amount remaining in the individual account can be paid in a lump sum to the employee.

While there is still some uncertainty regarding this policy update and its consequences on foreign residents in Shanghai and their employers, the expiry of the local circular is expected to affect labors costs, IIT liability and employees’ salaries. The compliance management on the employer’s side is also likely to be affected.

Contact our Shanghai team for assistance with tax planning and compliance.